In our previous article we explained why data governance is critical for enterprises. We also talked about the differences between defensive and offensive data governance to achieve your data strategy.

In this new article, we want to focus on what kind of data governance you need and its trend according your business sector.

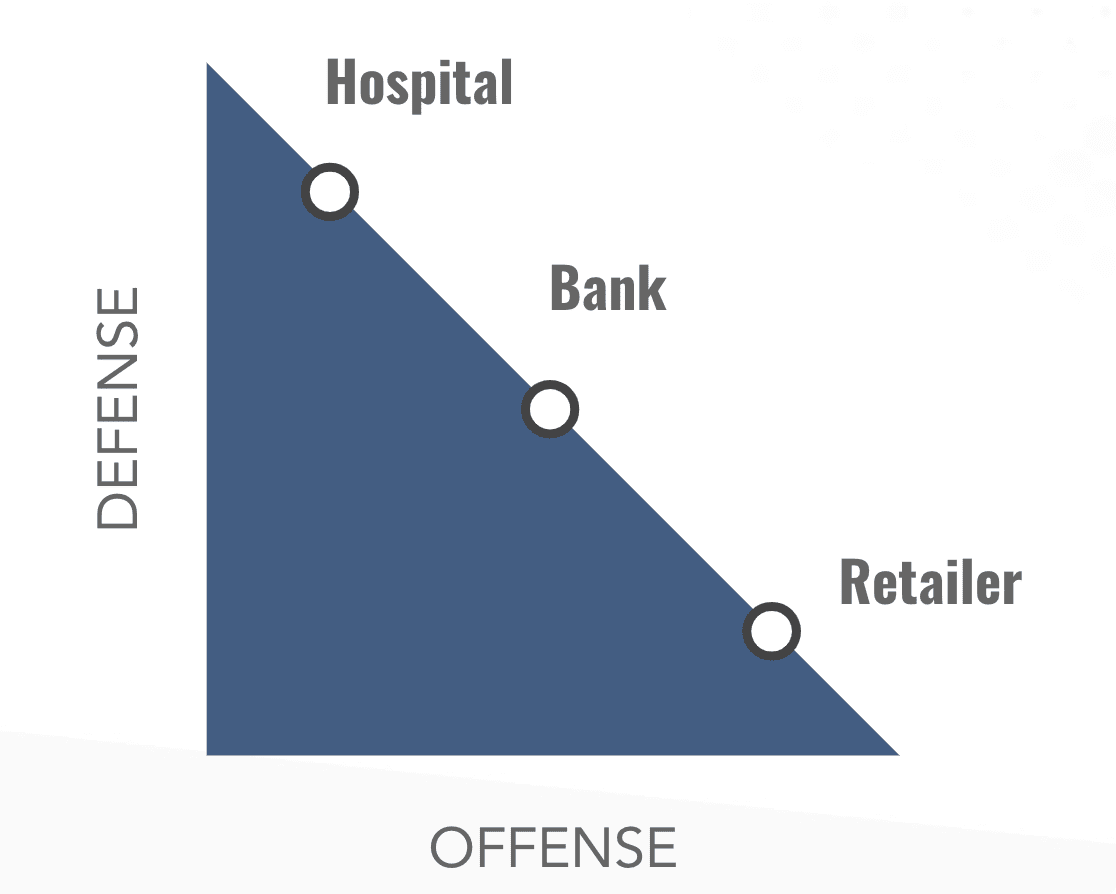

When it comes to implementing data governance, the approach an enterprise will take on and where they fit on the data strategy spectrum is solely based on their business environment. Indeed, a data governance strategy isn’t set up in a unique way: it’ll change from one sector to another.

Here we’ve taken a look at three different sectors: the healthcare/hospital sector, the retail/eCommerce sector and the banking/insurance sector. We’ve identified which approach each of these industries takes on today, and how it will differ from tomorrow.

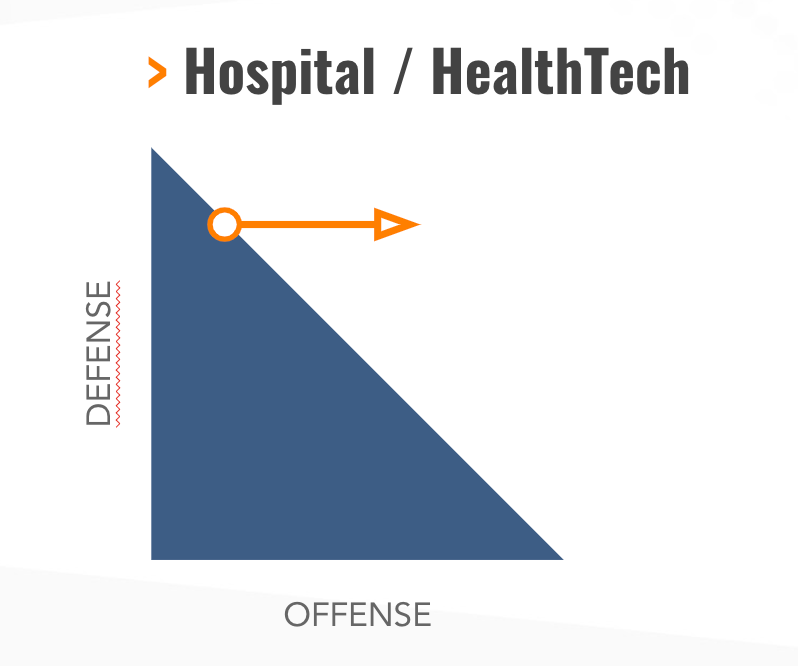

Healthcare & Data Governance

As hospitals have a highly regulated environment, their Data Governance strategy will take on a very defensive approach.

Indeed, today in the healthcare department, data quality and protection are essential. This sector has numerous amounts of sensitive information regarding their patients. Their data is used to save lives, treat specific symptoms, find new cures…So, bad data can lead to big risks!

However, with the rise of “Healthtech” companies, the industry is becoming more and more competitive. Hospitals and other healthcare businesses will have to merge towards a more offensive strategy in the years to come. This sector will have to balance between keeping their defensive approach to their data, and continuously innovating on their services in order to keep up with competition.

Retailers / eCommerce & Data Governance

On the other end of the spectrum, retailers and eCommerce actors take on an offensive data governance strategy.

This industry sees new actors come into the market every year, even every month! With all of this competition, it is crucial for retailers and online businesses to produce value with their data in order to offer personalized services, innovative products, etc.

With that said, consumers are now more and more protective with their data. With the rise of Machine Learning and AI techniques, people are questioning the ethics around their data’s uses. Also, the increasing rules and regulations regarding data privacy and security are forcing enterprises in this sector to change their data management strategies to comply with these new laws.

In the future, retailers will have to take on a defensive approach while still continuously producing value and innovating.

Banks / Insurance & Data Governance

The banking and insurance industries are right in the middle.

Both require strong defensive data governance because of the regulatory pressures they face. These sectors also work with very personal data, so it is essential to implement a strong defensive strategy.

Regardless, the banking and insurance industries are seeing new actors come in the market. With these new online infrastructures, digital services, and fully personalized options, this sector is seeing a rapid shift in data governance strategies.

Banks and insurance companies will have to not only keep focusing on their data quality and security but also take on a more offensive approach to their data in order to face these new web giants and offer innovative products and services.

How to start implementing a data governance strategy?

Getting started with implementing Data Governance can be a very overwhelming task!

At Zeenea, we’ve created a Lean Data Governance Canvas to help you ask and answer the right questions!

Just like the famous “Lean Canvas”, we’ve re-arranged elements to help enterprises set up “Lean” Data Governance and help your business find the right approach to take on data governance.