Zeenea for Financial Services

Finally trust your banking, insurance, and financial services data with our data discovery platform. Try ZeeneaZeenea helps financial services organizations extract maximum value from their existing data assets. Leverage our data discovery platform to:

- Initiate a data-driven strategy

- Meet increasingly demanding data regulations with innovative services

- Unlock value from ever-growing data that is generated by your digital services expansion

- Gain competitive advantage over InsurTech and FinTech that are investing heavily in IoT, Big Data, cybersecurity and machine learning

- Strike the right balance between defensive and offensive data governance.

Zeenea use cases in the financial services industry

![]()

Regulatory Compliance

![]()

Risk Modeling

![]()

Fraud detection

![]()

Data transparency

![]()

Personalized customer experiences

How Zeenea Unlocks Data for the Financial Services Industry

Our universal connectivity and API-first approach allows Zeenea to adapt to any system, and to any data strategy (edge, cloud, multi-cloud, cross-cloud, hybrid) to build an enterprise-wide information repository.

We provide the most comprehensive connectivity of the market with the ability to automate metadata curation with our wide range of connectors.

Our platform provides modular metamodel templates that enable banks and insurance companies to quickly and incrementally build easy-to-use and comprehensive models to serve business needs and regulatory reports.

Structure your assets’ documentation with simple “drag & drop” features and create documentation templates for each type of asset in the way that works best for you.

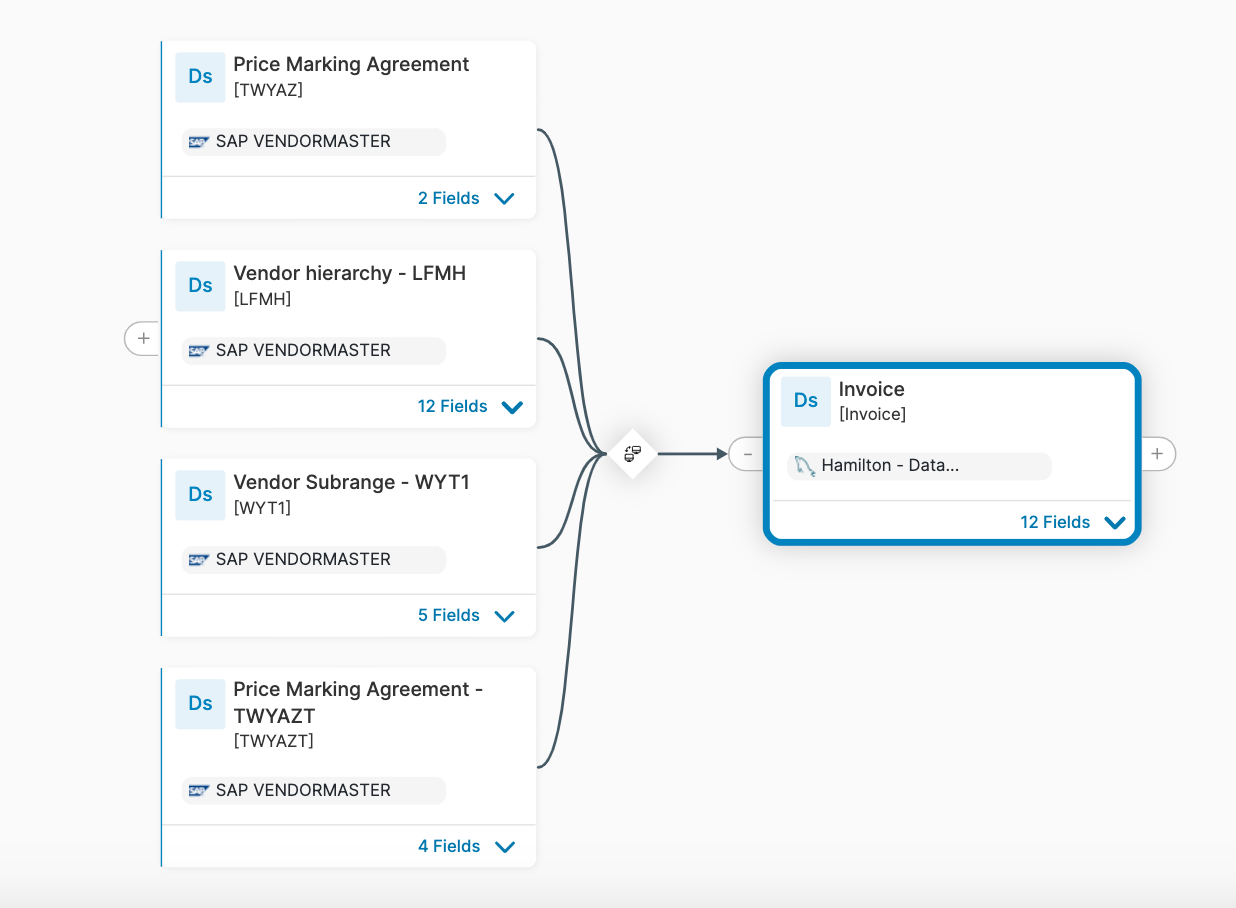

Zeenea automates data lineage by gathering data processes and data asset transformations from ETL platforms and data pipelines, or from manual descriptions for compliance and regulation.

Our solution also provides an audit trail for any action done in the data catalog.

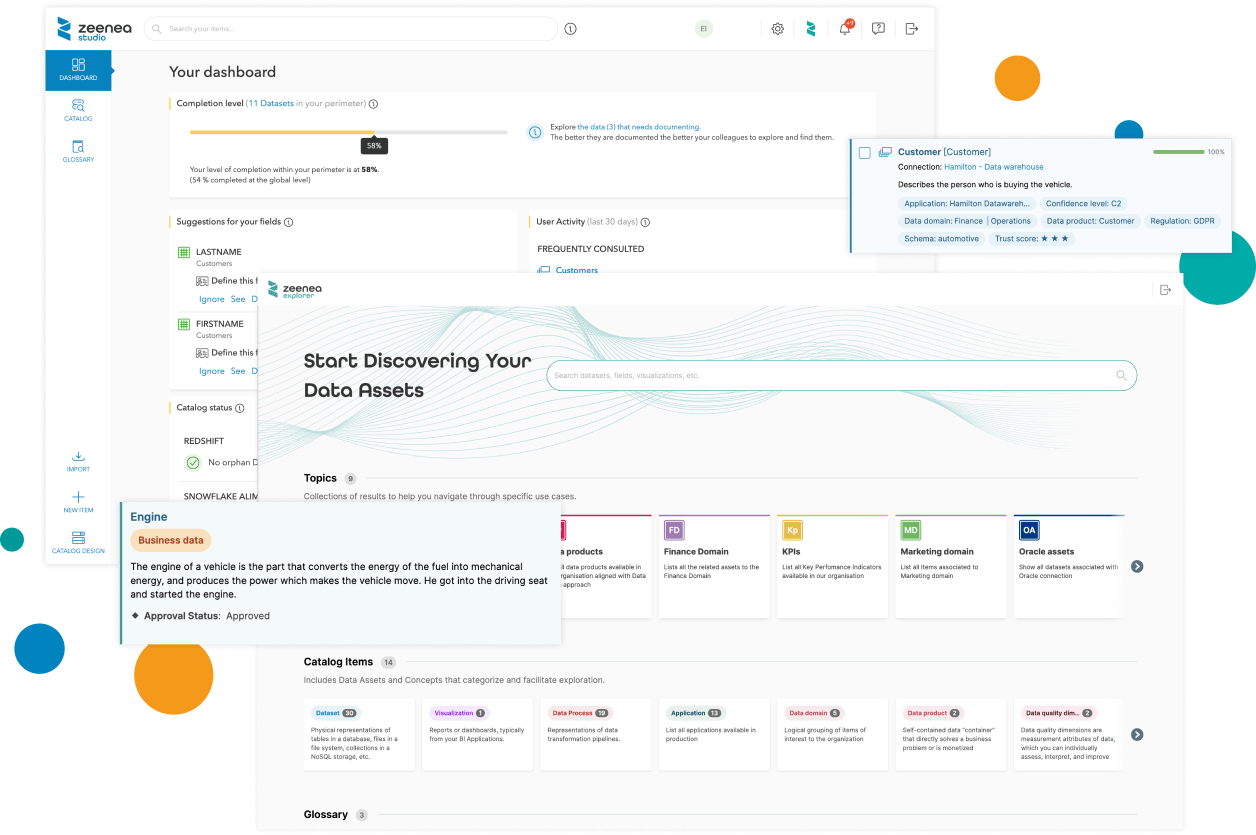

Both of our applications provide all your data consumers with sharing capabilities to allocate their knowledge on various objects in the catalog through collaborative features.

Thus, interactions between teams and experts will be simplified and the aggregation of knowledge acquired during use cases will finally be possible.

Testimonials

UNLOCK DATA FOR THE FINANCIAL SERVICES

Check out our other resources

Alex STEINER

Alex STEINER